Trilogy Health Services - 2025 Benefit Guide

Trilogy Health Services 2025 EMPLOYEE BENEFIT GUIDE

THRIVE IN 2025! Dear Team, At Trilogy, our mission is to be the Best Healthcare Company in the Midwest, and a key part of achieving that is ensuring we’re the best place for every team member to belong and to THRIVE. Our commitment goes beyond the work we do — it's about creating an environment where you can flourish. To support you in being your best, our total rewards program is designed with your needs in mind. We offer a comprehensive benefits package to support you and your family in all aspects of life: physically, mentally, financially and spiritually. This includes incentives to encourage healthy behaviors and resources to help you reach your well-being goals in 2025. I encourage you to explore our offerings and find what works best for you and your loved ones. Our Benefit Resource Center is ready to assist you in selecting the best coverage for you and your family. Thank you for being a vital part of the Trilogy family and for all the hard work you do. Yours in Service, Leigh Ann Barney I CEO Trilogy Health Services 2

4 New & Improved for 2025 5 Eligibility & Enrollment 8 How to Enroll in Benefits 10 Benefit Resource Center ENTS 12 Medical 14 First Stop Health – Virtual Care 16 Know Where to Go for Care 18 Anthem Sydney App 19 Pharmacy 20 Health & Well-being 21 Lifestyle Spending Account 22 Specialty Care Programs 24 Trilogy Cares 26 Health Savings Account 28 Dependent Care Flexible Savings Account 30 Dental 31 Vision 32 Basic and Voluntary Life and AD&D 33 Short and Long-Term Disability 34 TABLE OF CONTGroup Voluntary 36 Trilogy 401(k) Plan 38 Continuing Education 40 Employee Support Programs 42 Additional Benefits 44 Important Contacts 46 Legal Notices 3

NEW & IMPROVED FOR 2025! Click on ICONS below for additional information on each topic. Medical Insurance We now have three High Deductible Health Plans (HDHP) available to choose from. All three new medical plans include coverage options for employees, children, spouses and family. Deductibles, out-of-pocket maximums and premiums vary to provide a greater level of choice and coverage to support your individual needs. First Stop Health Skip the waiting room and receive quality care in minutes from anywhere. FREEvirtual primary care, FREE urgent care and FREE mental health care and FREEhealth coaching for employees and dependents enrolled in an HDHP. Lifestyle Spending Account Earn up to $600 ($300 more than 2024) in your LSA with more ways to earn and simplified reimbursement process. Health Savings Account Supporting your security with company matching contributions. 401(k) Employees hired January 1, 2025 and later will automatically be enrolled in the 401(k) plan at a 3% contribution rate. Employees can opt-out within the first 90 days of employment. Annually, the contribution rate will increase 1% to a maximum of 10%. 4

ELIGIBILITY & ENROLLMENT Thechart below details who is eligible to participate in Trilogy’s benefits and what benefits are available. Additional requirementsmay apply for eachprogram(tenure, age, condition specific). FULL-TIME PART-TIME EMPLOYEES EMPLOYEES • Benefit Resource Center • Benefit Resource Center • First Stop Health Virtual Care • Personify Health Well-being (requires medical enrollment) Platform • Hinge Health (requires medical • Nicotine Cessation (through enrollment) Personify Health) • Virta (requires medical enrollment) • Spending and Savings Accounts • Personify Health Well-being • Marketplace Chaplains Company Platform • Guild Education Benefit • Nicotine Cessation (through • Trilogy 401(k) Plan Perks Personify Health) • Paid Parental Leave • Basic Life and AD&D Insurance • Trilogy Perks • Spending and Savings Accounts • Transitions Benefit Group (Trilogy Pays100%) • Marketplace Chaplains (Medicare Support) • Guild Education Benefit • Will Prep (Requires Voluntary Life • Trilogy 401(k) Plan Enrollment) • Paid Parental Leave • Trilogy Perks • Transitions Benefit Group (Medicare Support) • Will Prep • Medical and Pharmacy (includes • Dental (does not include Anthem Specialty Programs) orthodontia coverage) • Dental • Vision Voluntary • Vision • Voluntary Life and AD&D • Voluntary Life and AD&D • Short and Long-Term Disability Benefits • Short and Long-Term Disability • Voluntary Accident and Critical • Voluntary Accident and Critical Illness Illness • Purchasing Power (You and Trilogy • Purchasing Power • Farmer’s GroupSelect Auto and share in the costs) • Farmer's GroupSelect Auto and Home Home • Pet • Pet Insurance • IDShield and LegalShield • IDShield and LegalShield 5

ELIGIBILITY & ENROLLMENT NEW HIRES Benefits begin 1st of the month after date of hire or status change to an eligible position. You must enroll within 30 days from date of hire or effective date of changing to a benefits eligible position. If this date falls between October 1 – December 1, you will be required to complete an additional enrollment window for your Annual Enrollment elections. Call the Benefit Resource Center for enrollment instructions. DEPENDENT ELIGIBILITY If you elect to cover eligible dependents, you will be required to submit supporting documentation as proof of your covered dependents. Eligible Dependents Include: LEGAL SPOUSE • Spouses are eligible to enroll in a medical plan if they do not have coverage available to them from their employer. CHILDREN • Under the age of 26 • Over the age of 26 are eligible only if they are incapacitated due to a disability. Dependent Verification You must provide documentation when initially adding any dependents to medical, dental or vision coverage. ADP will send a letter noting the deadline and type of documentation required. You must provide supporting documentation within 30 days of enrollment. 6

QUALIFYING LIFE EVENTS CLICK HERE to log into MyADP The elections made during annual enrollment, or your new hire enrollment remain until the next annual enrollment period unless you experience a qualifying life event (QLE). QLEs are IRS defined experiences such as marriage, divorce, birth, adoption or change in eligibility. Contact the Benefit Resource Center for additional information. The date of the QLE must be the date of the life event (birth, marriage, etc.). Supporting documentation is required within 30 days of the change. COBRA Youmaybeeligible for COBRA for up to 18 months if you experience a reduction in hours, terminate from the company, becomeMedicare eligible, or a dependent ages out at age 26, etc. If you or your dependent become eligible, you will be mailed a packet of information directly to your home within 7-10 business days of event from HealthEquity that will include pricing and paperwork. STAY IN THE KNOW! Take a moment to ensure your personal information is accurate in MyADP, such as your home address, email and date of birth, to ensure you receive important communications. Simply log into MyADP.com ordownload the ADPMobile app. 7

WALK Benefit Resource THROUGH Center BENEFIT The Benefit Resource Center is confidential ENROLLMENT and available to you and your covered dependents as part of your benefits program CLICK HERE to help you: to log into • Enroll in benefits MyADP • Understand and use your benefits • Resolve claims and billing issues • Assist with filing for a leave of absence • Compare costs for tests and procedures • Answer questions about your benefit options as you evaluate the best choice for your situation QUESTIONS? Contact the BRC by calling (888) 350-0532 or email [email protected]. 8

To discuss options, call the Benefit Resource Center. Once you are ready to enroll, here’s what you need to do: 1.Log into MyADP.com or use the ADP mobile app. 2.Go to “Benefits” section. 3.Select “Enroll Now”. 4.You must review and confirm your elections by clicking the button labeled “CONFIRM ENROLLMENT” at the end of the process. 5.Your elections and/or changes will not be received unless you do this. 6.Once confirmed, you have completed your enrollment. CLICK HERE to log into MyADP 9

BENEFIT RESOURCE CENTER The Benefit Resource Center is confidential and available to you and your covered dependents. The Benefit Resource Center is here to save you time and money by answering your questions, managing your leaves of absence (FMLA, Disability, Paid Parental Leave, etc.) maximizing benefits, and navigating the system on your behalf. The Benefit Resource Center can help you with almost any benefits or healthcare issues, including: • Answering questions about your benefits or leaves of absence • Comparing costs for tests and procedures • Reviewing your bills for errors and expediting corrections • Appealing a denied claim and overseeing the process • Finding in-network providers • Scheduling appointments • Verifying eligibility and coverage • Answering prescription drug questions and finding ways to Benefit & Leave save money Specialists are available: • Explaining the Qualified Life Monday – Friday Event process for birth of a child, 8 AM – 9 PM EST marriage, etc. You can reach the BRC by calling: (888) 350-0532 or via email: [email protected] 10

IT PAYS TO SHOP AROUND Let the Benefit Resource Center compare prices for your medical care The costs for any medical test or procedure can vary dramatically, even in the same town. For example, costs for an MRI can vary from $600 to $3,100. A knee surgery can range from $6,900 to $32,000! The process is easy: Call the Benefit Resource Center at (888) 350-0532 or email [email protected] to compare costs before scheduling any elective medical test or procedure. Choose a lower-cost provider based on the physicians and/or the facilities compared. Save money on your medical bills! 11

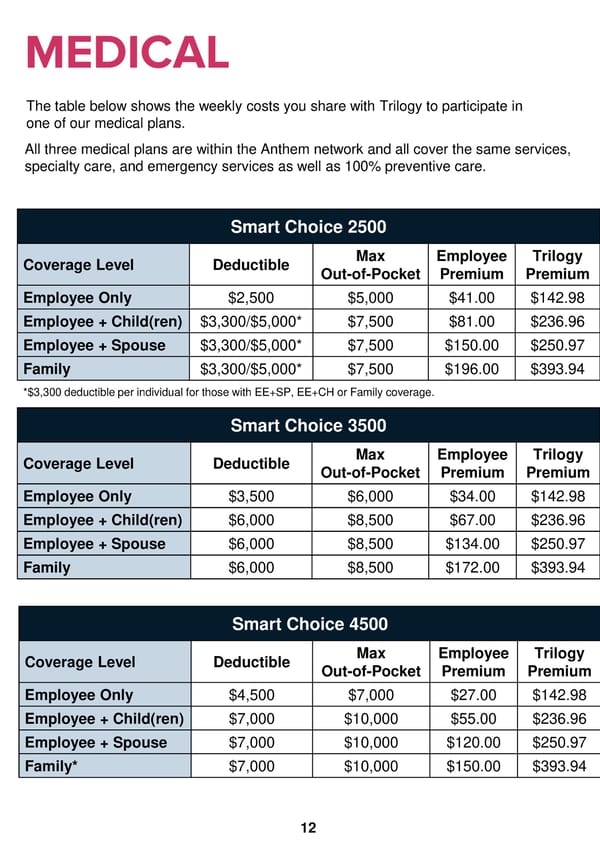

MEDICAL The table below shows the weekly costs you share with Trilogy to participate in one of our medical plans. All three medical plans are within the Anthem network and all cover the same services, specialty care, and emergency services as well as 100% preventive care. Smart Choice 2500 Coverage Level Deductible Max Employee Trilogy Out-of-Pocket Premium Premium Employee Only $2,500 $5,000 $41.00 $142.98 Employee + Child(ren) $3,300/$5,000* $7,500 $81.00 $236.96 Employee + Spouse $3,300/$5,000* $7,500 $150.00 $250.97 Family $3,300/$5,000* $7,500 $196.00 $393.94 *$3,300 deductible per individual for those with EE+SP, EE+CH or Family coverage. Smart Choice 3500 Coverage Level Deductible Max Employee Trilogy Out-of-Pocket Premium Premium Employee Only $3,500 $6,000 $34.00 $142.98 Employee + Child(ren) $6,000 $8,500 $67.00 $236.96 Employee + Spouse $6,000 $8,500 $134.00 $250.97 Family $6,000 $8,500 $172.00 $393.94 Smart Choice 4500 Coverage Level Deductible Max Employee Trilogy Out-of-Pocket Premium Premium Employee Only $4,500 $7,000 $27.00 $142.98 Employee + Child(ren) $7,000 $10,000 $55.00 $236.96 Employee + Spouse $7,000 $10,000 $120.00 $250.97 Family* $7,000 $10,000 $150.00 $393.94 12

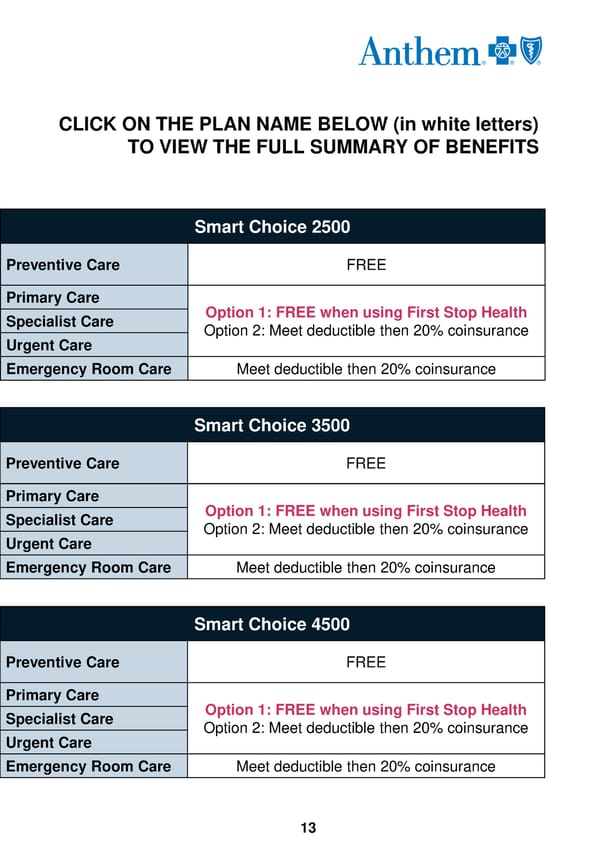

CLICK ON THE PLAN NAME BELOW (in white letters) TO VIEW THE FULL SUMMARY OF BENEFITS Smart Choice 2500 Preventive Care FREE Primary Care Option 1: FREE when using First Stop Health Specialist Care Option 2: Meet deductible then 20% coinsurance Urgent Care Emergency Room Care Meet deductible then 20% coinsurance Smart Choice 3500 Preventive Care FREE Primary Care Option 1: FREE when using First Stop Health Specialist Care Option 2: Meet deductible then 20% coinsurance Urgent Care Emergency Room Care Meet deductible then 20% coinsurance Smart Choice 4500 Preventive Care FREE Primary Care Option 1: FREE when using First Stop Health Specialist Care Option 2: Meet deductible then 20% coinsurance Urgent Care Emergency Room Care Meet deductible then 20% coinsurance 13

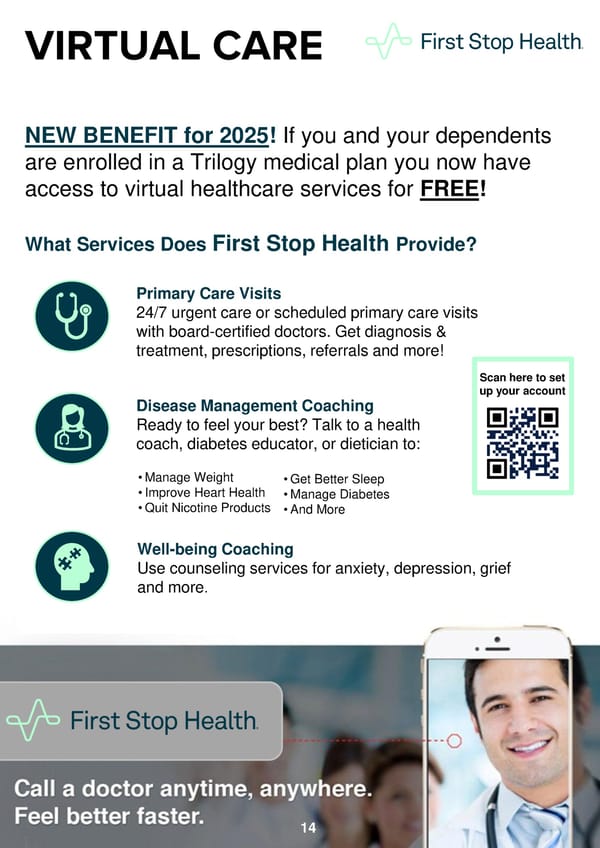

VIRTUAL CARE NEW BENEFIT for 2025! If you and your dependents are enrolled in a Trilogy medical plan you now have access to virtual healthcare services for FREE! What Services Does First Stop Health Provide? Primary Care Visits 24/7 urgent care or scheduled primary care visits with board-certified doctors. Get diagnosis & treatment, prescriptions, referrals and more! Scan here to set Disease Management Coaching up your account Ready to feel your best? Talk to a health coach, diabetes educator, or dietician to: • Manage Weight • Get Better Sleep • Improve Heart Health • Manage Diabetes • Quit Nicotine Products • And More Well-being Coaching Use counseling services for anxiety, depression, grief and more. 14

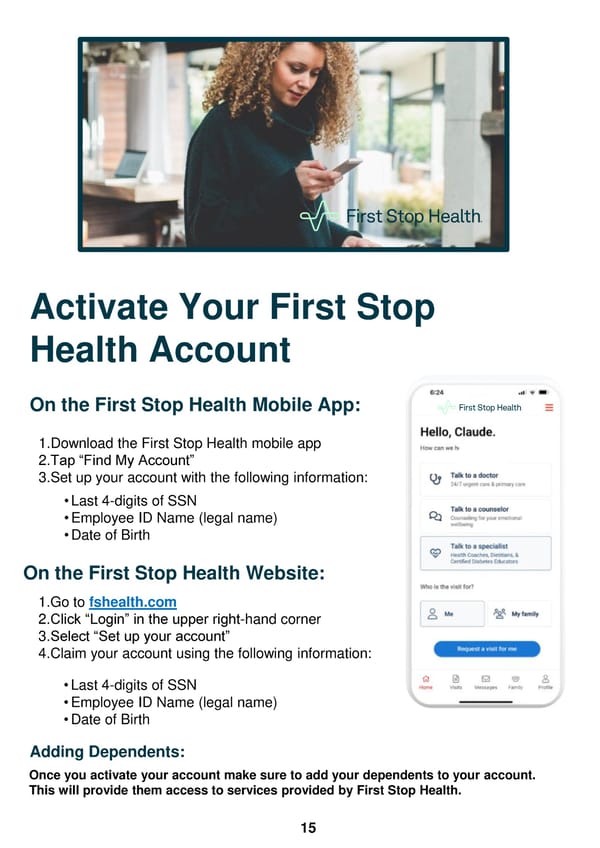

Activate Your First Stop Health Account On the First Stop Health Mobile App: 1.Download the First Stop Health mobile app 2.Tap “Find My Account” 3.Set up your account with the following information: •Last 4-digits of SSN •Employee ID Name (legal name) •Date of Birth On the First Stop Health Website: 1.Go to fshealth.com 2.Click “Login” in the upper right-hand corner 3.Select “Set up your account” 4.Claim your account using the following information: •Last 4-digits of SSN •Employee ID Name (legal name) •Date of Birth Adding Dependents: Once you activate your account make sure to add your dependents to your account. This will provide them access to services provided by First Stop Health. 15

This is a modal window.

KNOW WHERE TO GO FOR CARE How Should I Decide Which Health Setting To Use? VIRTUAL VIRTUAL VIRTUAL PRIMARY URGENT BEHAVIORAL CARE CARE HEALTH CARE Cost to You FREE! FREE! FREE! Cold & Flu Symptoms Anxiety Routine Check-Ups Allergies Depression When Should Annual Physicals Sinus Infection Grief Counseling I Go? Chronic Condition Pink Eye Substance Abuse Management Sprain or Strain Thoughts of Suicide Earache Relationship Issues Stomach Virus Financial Worries Appointments are Available 24/7 (24 Appointments are Typical Wait available as soon as hours, 7 days a week). typically scheduled Time same-day or within 3 business days next-day. Average of only a of request. 7-minute wait time! 16

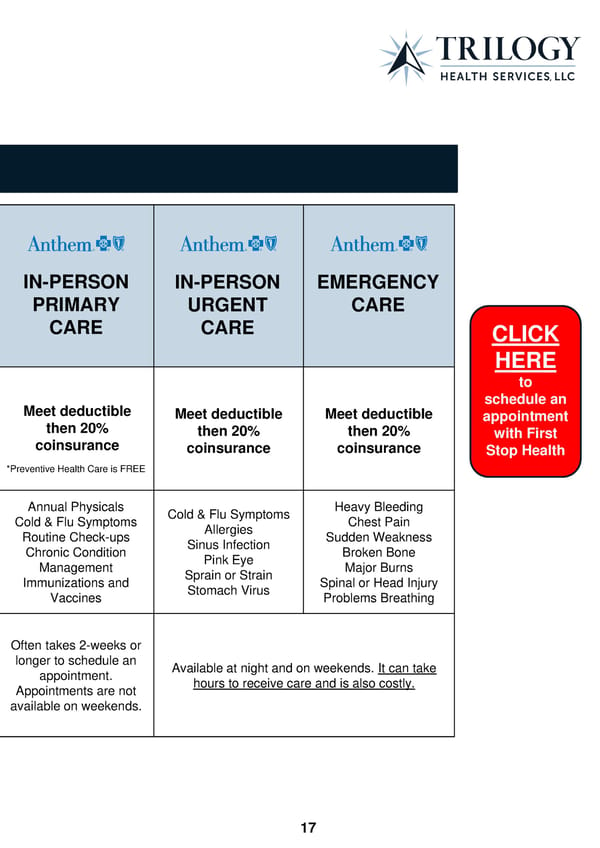

IN-PERSON IN-PERSON EMERGENCY PRIMARY URGENT CARE CARE CARE CLICK HERE to Meet deductible schedule an then 20% Meet deductible Meet deductible appointment coinsurance then 20% then 20% with First coinsurance coinsurance Stop Health *Preventive Health Care is FREE Annual Physicals Cold & Flu Symptoms Heavy Bleeding Cold & Flu Symptoms Allergies Chest Pain Routine Check-ups Sinus Infection Sudden Weakness Chronic Condition Pink Eye Broken Bone Management Sprain or Strain Major Burns Immunizations and Stomach Virus Spinal or Head Injury Vaccines Problems Breathing Often takes 2-weeks or longer to schedule an Available at night and on weekends. It can take appointment. hours to receive care and is also costly. Appointments are not available on weekends. 17

MEDICAL How Does My Deductible Work? If you cover a dependent under any of the medical plans offered by Trilogy your medical plan includes an embedded individual deductible. Anembeddedindividual deductible keeps track of each member's individual deductible separately. Once you or any of your covered dependents reach their own embedded individual deductible, the plan coinsurance will begin paying post- deductible benefits for that person only. Once the combined family deductible has been met, the plan coinsurance will apply for the entire family. ANTHEM SYDNEY APP SM The Anthem Sydney Health app provides you access to your healthcare information and your Anthem ID card. What Can You Do With Anthem’s Sydney App? • Access your Anthem ID • View medical claims • Find a doctor 18

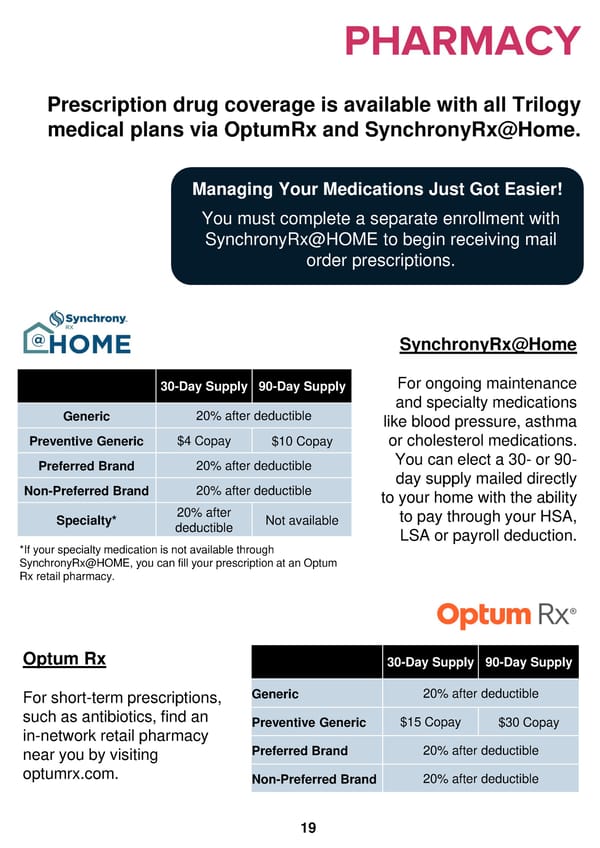

PHARMACY Prescription drug coverage is available with all Trilogy medical plans via OptumRx and SynchronyRx@Home. Managing Your Medications Just Got Easier! You must complete a separate enrollment with SynchronyRx@HOME to begin receiving mail order prescriptions. SynchronyRx@Home 30-Day Supply 90-Day Supply For ongoing maintenance 20% after deductible and specialty medications Generic like blood pressure, asthma Preventive Generic $4 Copay $10 Copay or cholesterol medications. Preferred Brand 20% after deductible You can elect a 30- or 90- Non-Preferred Brand 20% after deductible day supply mailed directly to your home with the ability 20% after You must complete a separate to pay through your HSA, Specialty* deductible Not available enrollment with SynchronyRx@HOME LSA or payroll deduction. *If your specialty medication is not available through to begin receiving a mail order SynchronyRx@HOME, you can fill your prescription at an Optum prescription. Rx retail pharmacy. Optum Rx 30-Day Supply 90-Day Supply For short-term prescriptions, Generic 20% after deductible such as antibiotics, find an Preventive Generic $15 Copay $30 Copay in-network retail pharmacy near you by visiting Preferred Brand 20% after deductible optumrx.com. Non-Preferred Brand 20% after deductible 19

HEALTH & WELL-BEING PERSONIFY HEALTH Personify Health is our well-being partner available to all employees full-time and part-time age 18+. This is a personalized well-being andrewards platform that encourages you to make healthier decisions and guides you on your ownwell-being journey. With Personify Health you can: • Access information on nicotine cessation, healthy eating and Well-being Reasonable reducing stress. Alternative Standard • Track your steps! • Complete daily habits. The Trilogy health plans are committed to helping you achieve • And moreall while earning your best health. Rewards for dollars for your Lifestyle participating in a well-being program Spending Account! are available to all employees. If you think you might be unable to meet a standard for a reward under this well-being program, you might qualify for an opportunity to earn the same reward by different means. Contact Personify Health at 888-671-9395 or CLICK HERE https://personifyhealth.zendesk.com/, to log into and we will work with you (and, if you wish, with your doctor) to find a Personify well-being program with the same Health reward that is right for you in light of your health status. 20

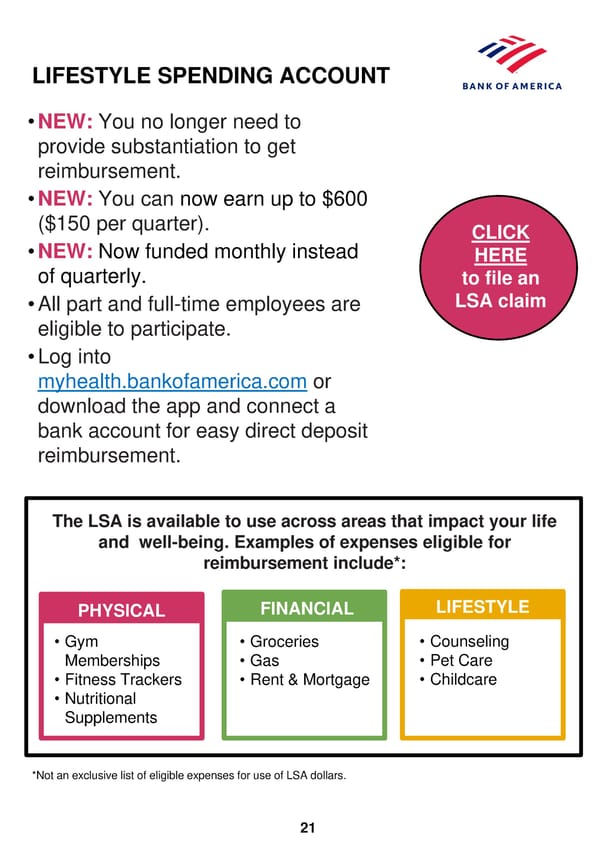

LIFESTYLE SPENDING ACCOUNT •NEW: You no longer need to provide substantiation to get reimbursement. •NEW: You can now earn up to $600 ($150 per quarter). CLICK •NEW: Now funded monthly instead HERE of quarterly. to file an •All part and full-time employees are LSA claim eligible to participate. •Log into myhealth.bankofamerica.com or download the app and connect a bank account for easy direct deposit reimbursement. TheLSA isavailable to use across areas that impact your life and well-being. Examples of expenses eligible for reimbursement include*: PHYSICAL FINANCIAL LIFESTYLE • Gym • Groceries • Counseling Memberships • Gas • Pet Care • Fitness Trackers • Rent & Mortgage • Childcare • Nutritional Supplements *Not an exclusive list of eligible expenses for use of LSA dollars. 21

SPECIALTY CARE PROGRAMS VIRTA PREDIABETES, TYPE HINGE HEALTH DIGITAL 2 DIABETES AND WEIGHT MUSCULOSKELETAL LOSS PROGRAM PROGRAM Trilogy covers the cost of Virta Hinge Health is an end-to-end for all medically-enrolled digital musculoskeletal (MSK) employees and dependents clinic for preventive, acute, with type 2 diabetes or chronic and surgery recovery. prediabetes. Virta is also With Hinge Health you get covered for those with a BMI of unlimited visits with a team of 25orgreater who are licensed therapists and interested in safe and specialists (orthopedic sustainable weight loss. With surgeons, nurses, nutritionists, Virta, you can lose weight, and board- certified health reduce medications, and save coaches). The Hinge Health moneysoyoucangetbackto program can be accessed what you love. through your Sydney Health mobile app. 22

BUILDING HEALTHY CANCER CARE FAMILIES – MATERNITY ENGAGEMENT SUPPORT PROGRAM Every family grows in its own After a cancer diagnosis, it may way. That’s part of what makes bedifficult to know what the next each one unique. The program step is, or which treatment plan is free and can help your family will work best for you. The grow strong whether you’re program helps you through each trying to conceive, expecting a step of your cancer journey by child, or in the thick of raising providing you the support and children. Building Healthy resources you need. The Families offers personalized, program provides: digital support through the Sydney Health mobile app or on • Virtual second opinions from anthem.com. This convenient a board-certified oncologist to huboffers an extensive ensure you are on the right collection of tools and track from your original information to help you navigate diagnosis your family’s unique journey. • Access to on-demand , clinical-quality medical exams from any location through TytoCare Technology • VIP services at best-in-class clinical trials 23

TRILOGY CARES At Trilogy, your health and well-being are very important to us! MARKETPLACE CHAPLAINS The Marketplace Chaplains Team is available 24/7 to extend confidential care, concern, compassion, and hope to you and your family in any situation such as stress management, suicide prevention, grief/discouragement, aging parents, crisis response and health concerns. Support provided by them is independent of any religious beliefs. There is never a cost to you or your immediate family membersforuseoftheChaplain CareTeam service. ScantheQRcodeorgodirectlytotheappstorefor afree downloadof the MyCHAPapp.Usethisappto connect with your Chaplain Care Team by phone, email, or text; to schedule an appointment; or to receive helpful resources through the app. Once downloaded you will need to enter the Location ID number: 121193. 24

ANTHEM INCLUSIVE CARE Anthem Inclusive Care makes it easier for all enrolled members. This no-cost program is available to members enrolled in a Trilogy medical plan and can help you find doctors who will treat you with dignity and respect, and who are experienced in providing compassionate, high- quality LGBTQIA+ health care. Specialty Trained Health Guide • Understanding knowledge of LGBTQIA+ concerns • Connection to doctors and behavioral care providers familiar and sensitive to your needs. Benefits That Focus on Your Whole Health • Whole-health care regardless of gender identity. • World Professional Association for Transgender Health (WPATH) Standards of Care for gender affirmation. Gender Affirmation Surgery Concierge • Can help you find a surgery center and coordinate multiple providers. 25

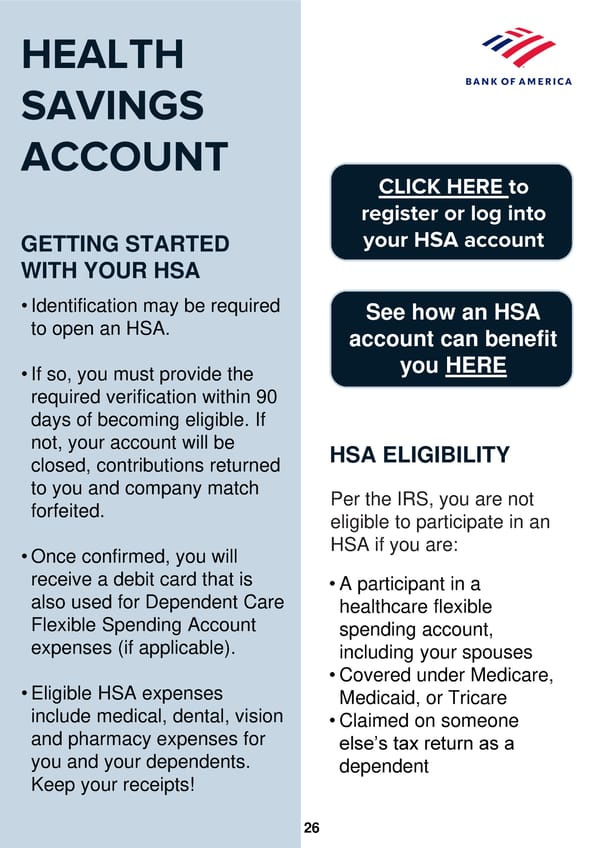

HEALTH SAVINGS ACCOUNT CLICK HERE to register or log into GETTING STARTED your HSA account WITH YOUR HSA • Identification may be required See how an HSA to open an HSA. account can benefit • If so, you must provide the you HERE required verification within 90 days of becoming eligible. If not, your account will be HSA ELIGIBILITY closed, contributions returned to you and company match Per the IRS, you are not forfeited. eligible to participate in an • Once confirmed, you will HSA if you are: receive a debit card that is • A participant in a also used for Dependent Care healthcare flexible Flexible Spending Account spending account, expenses (if applicable). including your spouses • Eligible HSA expenses • Covered under Medicare, include medical, dental, vision Medicaid, or Tricare and pharmacy expenses for • Claimed on someone you and your dependents. else’s tax return as a Keep your receipts! dependent 26

TRILOGY CONTRIBUTIONS Trilogy supports your security with company matching contributions. TRILOGY ANNUAL MATCH* Employee Only Employee + Employee + Family Child(ren) Spouse $500 $1,200 $500 $1,200 *Trilogy matches $1 for $1 up to the limit noted above based on coverage level elected. IRS CONTRIBUTION LIMITS Per the IRS, you and Trilogy combined may contribute up to the following amounts in 2025: • $4,300 for Employee Only coverage • $8,550 for Employee + Child(ren), Employee + Spouse, or Family coverages • If you are age 55 or older during 2025, you may contribute an additional $1,000 BENEFITS OF AN HSA •Trilogy can contribute to an HSA. •Has a triple tax benefit! •Your contributions are deducted before taxes from your pay. •You gain interest tax free. •Your withdrawals for allowed expenses are tax free. •Your balance rolls over year-to-year. •If you leave the company your balance goes with you. •The contribution limits for an HSA are higher. •Can be invested in the stock market just like a 401(k). 27

DEPENDENT CARE FLEXIBLE SAVINGS ACCOUNT WHAT IS A DEPENDENT CARE FSA? TheDependentCareFSA, administeredbyBankof America, allows you to pay for day care, in-home childcare and before or after school care for dependents under age 13. A Dependent Care FSA does not cover any medical, dental, vision or pharmacy expenses. DEPENDENT CARE FSA DETAILS • $5,000 per family • $2,500 if married and filing separately • Elections cannot be changed throughout the year unless you experience a qualifying life event. YourDependent Care FSA will automatically be opened on your behalf by Bank of America. Once your enrollment has been successfully processed, awelcomekitincluding step-by-step instructions onhowtomaximizethebenefits of your account will be emailed to you. If you have not yet added your email information to MyADP, the welcome kit will be mailed to your home address within 5-7 business days. 28

GETTING STARTED WITH YOUR DEPENDENT CARE FSA Adebit card will be sent to your home around the same time the welcome kit is emailed to you. This debit card will also be used for anyeligible HSA expenses (if applicable). You can use the debit card to pay for eligible expenses at the point of service, or you can pay for expenses up front and submit CLICK HERE the claim to Bank of America to register or log for reimbursement. into your FSA account IMPORTANT PLAN DEADLINES Please keep in mind the following deadlines as you decide on the amount you will contribute to your Dependent Care FSA this plan year: •Use it our Lose It: You have •Trilogy’s Dependent Care FSA includes a grace period, until March 31, 2026 to submit which means the funds claims incurred during the 2025 contributed to your Dependent plan year and grace period – any Care FSA during the January remaining funds will be forfeited. 1, 2025 plan year are available to use for expenses incurred through March 15, 2026. 29

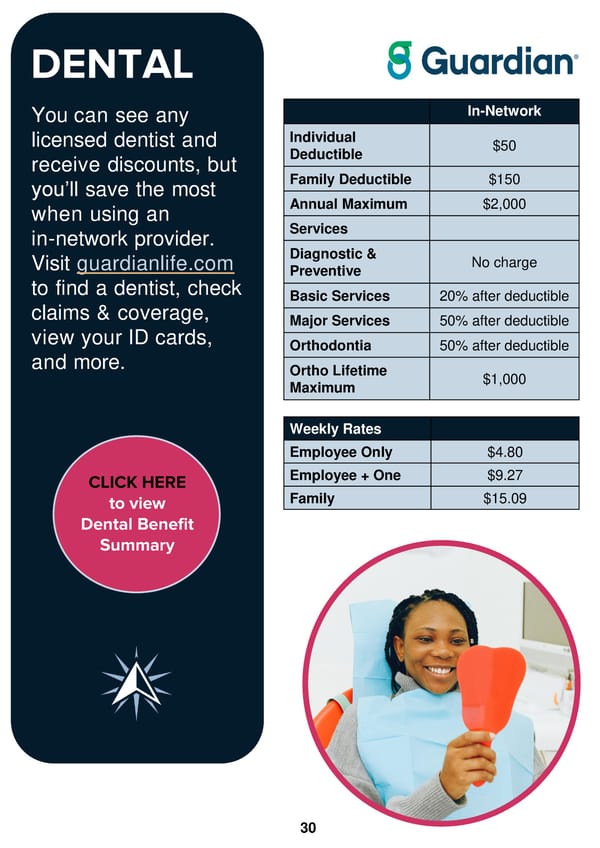

DENTAL You can see any In-Network licensed dentist and Individual $50 receive discounts, but Deductible you’ll save the most Family Deductible $150 when using an Annual Maximum $2,000 in-network provider. Services Visit guardianlife.com Diagnostic & No charge to find a dentist, check Preventive claims & coverage, Basic Services 20% after deductible view your ID cards, Major Services 50% after deductible and more. Orthodontia 50% after deductible Ortho Lifetime $1,000 Maximum Weekly Rates Employee Only $4.80 CLICK HERE Employee + One $9.27 to view Family $15.09 Dental Benefit Summary 30

VISION Regular vision care is an important part of your overall health. Visit guardianlife.com to find an in-network provider, check claims & coverage, view your ID cards, and more. CLICK HERE to view Vision Benefit Summary In Network VSP Network Davis Network Vision Exam $10 Copay $10 Copay Lenses $20 Copay $20 Copay $130 Retail Max + $130 Retail Max + Frames 20% off remaining 20% off remaining balance balance Contact Lenses $130 max, copay $130 Retail Max + Elective waived 15% off remaining balance Non-Elective Covered at 100% Covered at 100%, after $20 Copay Copay waived Weekly Payroll Contribution Employee Only $1.00 Family $2.50 31

LIFE AND AD&D INSURANCE Trilogy provides eligible full-time employees Basic Life and AD&D insurance, either $15,000 or one times basic annual earnings (up to a maximum of $100,000), at no cost to you. Your total benefit is reduced by 35% at age 65, 60%atage70,75%atage75,and85%atage80. VOLUNTARY LIFE INSURANCE Voluntary coverage can be purchased for you and your eligible dependents without answering medical questions up to the Guaranteed Issue amount if elected upon hire or upon gaining eligibility. Your cost for coverage under the Voluntary Insurance plans can be found in myadp.com. Maximum Guaranteed Benefit Coverage Amount Coverage Issue Amount Supplemental 1-5x’s the basic Employee Life and AD&D annual earnings, in $250,000 $250,000 increments of $1,000 Up to 50% of the employee’s Spouse Life Insurance Supplemental Life $50,000 $50,000 benefit, in increments of $5,000 Children Life Insurance $10,000 per child $10,000 per $10,000 per (at birth) child child GUARANTEED ISSUE If you purchase Voluntary Insurance during your new hire enrollment, you are guaranteed coverage of up to $250,000 for yourself and $50,000 for your spouse. If you apply for coverage after your new hire enrollment period, you will be required to answer medical questions before Guardian will approve your requested coverage amount. Guardian will review your request and will notify you of approval or denial. 32

DISABILITY INSURANCE You can purchase Short-Term (STD) and/or Long-Term Disability (LTD) coverages through Guardian. Disability insurance is designed to provide you with continued income while you are out of work due to an illness, accident, or life event. Your cost for disability coverage can be found in MyADP.com. SHORT-TERM DISABILITY LONG-TERM DISABILITY STD insurance provides a benefit The LTD plan pays a benefit of amount of 60% of your weekly 60% of your monthly income up pre-disability earnings, up to a to a maximum of $10,000. weekly maximum benefit of $750, Benefits begin on the 181st for as long as you remain calendar day of absence and disabled (up to 24-weeks). may last for up to five years for Benefits begin following a non-work-related 14-calendar day waiting period accident/sickness. from your first date of absence. NOTE: The LTD plan includes a pre-existing condition clause, which includes pregnancy. CLICK HEREto view CLICK HEREto view STD Benefit Summary LTD Benefit Summary IMPORTANT! If you choose to waive long-term disability coverage during your new hire enrollment period and decide to enroll at a later date, you will be required to answer medical questions before Guardian will review your request and will notify you of approval or denial. WILL PREPARATION All full-time and part-time employees enrolled in Voluntary Life insurance will also have access to a participating plan attorney who will prepare or update you or your Spouse’s will at no cost to you. Contact Guardian at (877) 433-6789 for additional information. 33

GROUP VOLUNTARY ACCIDENT INSURANCE Voluntary Accident and Critical Illness Insurance coverage is available to you at discounted group rates through Guardian. The benefits are paid directly to you and can be used to pay for medical plan deductibles and copays, out-of-network treatments, and your family’s everyday living expenses. Your cost for coverage can be found at myadp.com. Accident insurance provides a lump-sum payment in the event you or your covered dependents experience a covered accident or related medical treatment and service. The chart provides a summary of the Group Accident policy benefits. BENEFIT CLICK HERE Emergency Room Visit $75 to view Doctor’s Visit $50 Accident Benefit Ambulance (Ground/Air) $200/$750 Summary Fractures Up to $3,000 DON’T FORGET! If you complete certain health screenings and preventive measures, the Voluntary Accident plan will pay you a $50 benefit per calendar year. The Critical Illness insurance plan will also pay you, your covered Spouse and covered child $50 each for completing certain health screenings as well! 34

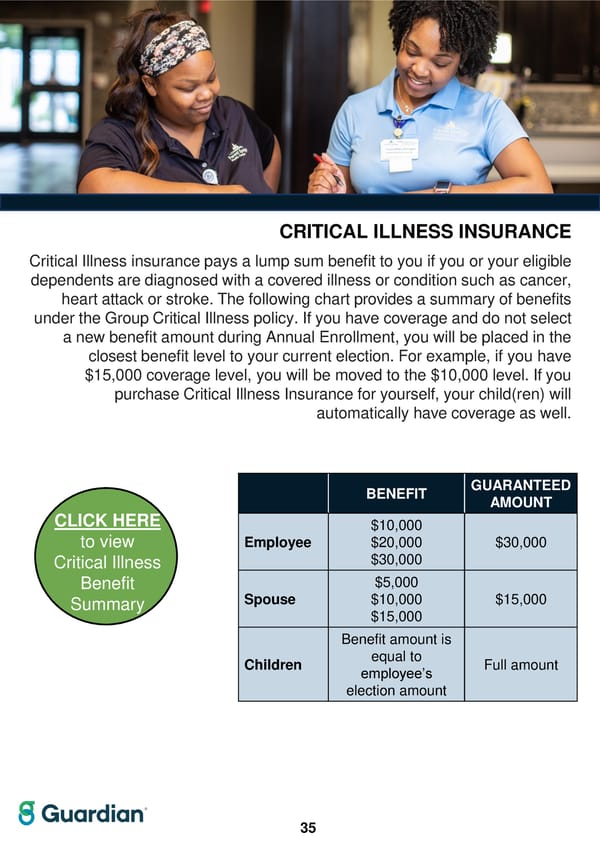

CRITICAL ILLNESS INSURANCE Critical Illness insurance pays a lump sum benefit to you if you or your eligible dependentsarediagnosedwithacovered illness or condition such as cancer, heart attack or stroke. The following chart provides a summary of benefits undertheGroupCritical Illness policy. If you have coverage and do not select anewbenefitamountduring AnnualEnrollment, you will be placed in the closest benefit level to your current election. For example, if you have $15,000 coverage level, you will be moved to the $10,000 level. If you purchase Critical Illness Insurance for yourself, your child(ren) will automatically have coverage as well. BENEFIT GUARANTEED AMOUNT CLICK HERE $10,000 to view Employee $20,000 $30,000 Critical Illness $30,000 Benefit $5,000 Summary Spouse $10,000 $15,000 $15,000 Benefit amount is Children equal to Full amount employee’s election amount 35

TRILOGY 401(k) PLAN TheTrilogy 401(k) Retirement Savings Plan is administered by Bank of America and provides you with an excellent way to save for your retirement. How to Enroll: When to Enroll: Employees hired January 1, You are eligible to defer to the 2025 and later will automatically plan on the first of the month be enrolled in the 401(k) plan at following your date of hire. Must a 3% contribution rate. be 21 or older to enroll. Employees can opt-out within the first 90 days of employment. Annually, the contribution rate will increase 1% to a maximum of 10%. ROLL OVER YOUR 401(k) BALANCE Full-time and part-time employees are eligible to roll over applicable balances. Contact Bank of America at (800) 228-4015 or visit benefits.ml.com for more information. CLICK HERE to register or log into 401(k) account 36 36

TRILOGY 401(k) PLAN ELIGIBLE TRILOGY PRE-TAX AFTER-TAX EMPLOYEE CONTRIBUTION CONTRIBUTION ROTH CONTRIBUTION CONTRIBUTIONS* If you are at least age 21andafull-time or Trilogy matches $0.25 . part-time employee, for every Employees hired January 1, 2025 and later will you may contribute $1.00 you contribute automatically be enrolled in the 401(k) plan at a from your paycheck up to 10% of your 3% contribution rate. Employees can opt-out upto the plan IRS weekly pay. This within the first 90 days of employment. Annually, limit ($23,500 for applies to both your the contribution rate will increase 1% to a 2025) on the first of pre-tax and/or after- maximum of 10%. the month following tax Roth deferrals. date of hire. Youcanelect to defer either pre-tax or after-tax Roth If you are age 50 or You are eligible for Your deferred contributions. Simply older, you may be the employer match contribution is contact Bank of America eligible to contribute as soon as you withheld from your at (800) 228-4015. an additional $7,500 become eligible to paycheck before for 2025. contribute to the plan. taxes. Your deferred contribution is withheld from your paycheck after taxes. Youcanchangethe Vesting schedule: Fundswithdrawn from amount you Company Fundswithdrawn from your account during contribute at any time contributions vest your account during retirement are not and all employee 20%each year over retirement are subject subject to income tax, contributions are five years. After 5 to income tax. provided you are at least immediately 100% years of employment, 59½. vested. you are fully vested. EMPLOYEES EARNING $160,000 OR ABOVE MAY BE CAPPED ON DEFERRAL OPTIONS. 37

EDUCATIONBENEFITS Trilogy provides multiple options for you to further develop your career and education through a variety of partially and fully-funded programs through Guild. Ready to Get Started? 1. Visit the Guild website: trilogyhs.guildeducation.com 2. Create an account and complete your profile 3. Browse the catalog to view all programs available to you 4. Choose a program, then click “Apply Now” Important: Before applying, you must discuss program enrollment and education goals with your managerandmust haveproof your manager approvesprogram enrollment. 38

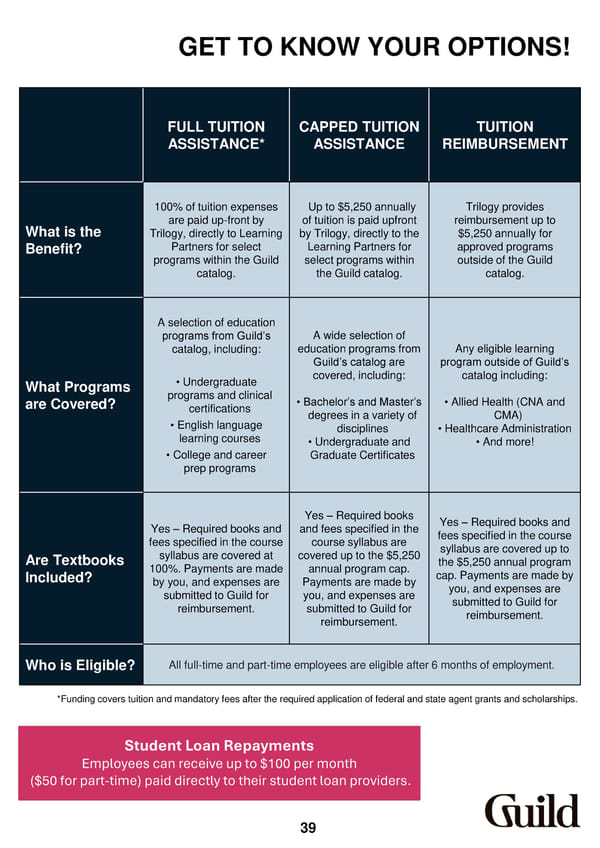

GET TO KNOW YOUR OPTIONS! FULL TUITION CAPPED TUITION TUITION ASSISTANCE* ASSISTANCE REIMBURSEMENT 100% of tuition expenses Up to $5,250 annually Trilogy provides What is the are paid up-front by of tuition is paid upfront reimbursement up to Trilogy, directly to Learning by Trilogy, directly to the $5,250 annually for Benefit? Partners for select Learning Partners for approved programs programs within the Guild select programs within outside of the Guild catalog. the Guild catalog. catalog. A selection of education A wide selection of programs from Guild’s catalog, including: education programs from Any eligible learning Guild’s catalog are program outside of Guild’s What Programs • Undergraduate covered, including: catalog including: are Covered? programs and clinical • Bachelor’s and Master’s • Allied Health (CNA and certifications degrees in a variety of CMA) • English language disciplines • Healthcare Administration learning courses • Undergraduate and • And more! • College and career Graduate Certificates prep programs Yes – Required books Yes – Required books and Yes – Required books and and fees specified in the fees specified in the course fees specified in the course course syllabus are syllabus are covered up to Are Textbooks syllabus are covered at covered up to the $5,250 the $5,250 annual program Included? 100%. Payments are made annual program cap. cap. Payments are made by by you, and expenses are Payments are made by you, and expenses are submitted to Guild for you, and expenses are submitted to Guild for reimbursement. submitted to Guild for reimbursement. reimbursement. Who is Eligible? All full-time and part-time employees are eligible after 6 months of employment. *Funding covers tuition and mandatory fees after the required application of federal and state agent grants and scholarships. Student Loan Repayments Employees can receive up to $100 per month ($50 for part-time) paid directly to their student loan providers. 39

EMPLOYEE SUPPORT PROGRAMS PARENTAL LEAVE BENEFIT Parental leave is available to all part and full-time employees who have worked at Trilogy for at least six consecutive months. Trilogy’s parental leave benefit pays you 100% of your weekly earnings. The length of your benefit is basedonhowlongyouhaveworkedwithTrilogy. • Six months to one year of consecutive employment withTrilogy: 100%salary replacementforthreeweeks. • One year or more of consecutive employment withTrilogy: 100%salary replacementforsix weeks. LeaverequestsmustbesubmittedtotheBRC at [email protected]. TRILOGY PERKS DISCOUNT PROGRAM Trilogy Perks offers local and national discounts on hotels, restaurants, movie theaters, theme parks, and more. Trilogy Perks has more than 100,000 available offers such as cell phone and retail discounts. Trilogy Perks is available to all eligible employees by following these easy steps: 1. First-time users register with the registration code: TrilogyPerks411 2. Repeat visitors simply enter your login and password previously used 40

STARS RECOGNITION PROGRAM At Trilogy, STARS is the heart of our commitment to both a positive and inclusive workplace culture. Everyone who lives our company’s mission and values deserves to be rewarded and by participating in STARS we strengthen our sense of community and shared purpose. Service, Team Approach, Attention to Details, Responsiveness, and a Servant’s Heart. To support our culture of recognition and appreciation, everyone has a chance to recognize and appreciate each other with STARS. Employees can thank each other for their help as well as celebrate life events and personal accomplishments, among other things. Likewise, leaders can use STARS to reward team members for their outstanding contributions. STARS earned for exceptional service to others and dedication to our company are like cash that can be redeemed for gifts on the STARS site. The easiest way to access the STARS site is by visiting workrede. Have questions? Reach out to your supervisor or local HR representative. TRANSITIONS MEDICARE & SOCIAL SECURITY SUPPORT Transitions provides education and assistance on Medicare options, Social Security planning, Retirement Readiness, and COBRA alternatives that is FREE for you and your family. TAX PREPARATION • Tax Slayer • Abenity Trilogy Perks Discount Program 41

ADDITIONALBENEFITS Purchasing Power allows eligible employees to purchase computers, electronics, exercise equipment, education, and household goods through payroll deductions. There is no credit check, and the risk often associated with sub-prime financing is eliminated. Eligible employees are full-time and part-time employees whomeetthefollowing criteria: • Are at least 18 years of age • Earn a minimum of $20,000 annually • Have either a bank account or credit card (to be used in the event of non-payment through payroll deduction) Your credit limit is based on your length of service, with an introductory limit of $250. Your credit limit will increase as you attain additional milestones. Being a Trilogy employee provides you additional benefits with Bank of America. Click the Bank of America logo above to learn more about checking account options. 42

CLICK ON A LOGO FOR ADDITIONAL INFORMATION. Includes privacy and security monitoring, consultation, and 24/7 covered emergencies with a free mobile app. Complete identity recovery services are provided by IDShield Licensed Private Investigators with a $1 million service guarantee to ensure that if your identity is stolen, it will be restored to pre-theft status. Must be 18 or older to enroll. Dependents can also be covered up to age 19 or 24 if a full-time student. Talk to an attorney about an unlimited number of personal legal matters without worrying about the hourly costs. Must be 18 or older to enroll. Dependents can also be covered up to age 19 or 24 if a full-time student. Farmers offers home, boat, condo, motor home, recreational vehicle and renter’s insurance. Pet insurance policies covers diagnostic tests, x-rays, prescriptions, hospitalization, and more. 43

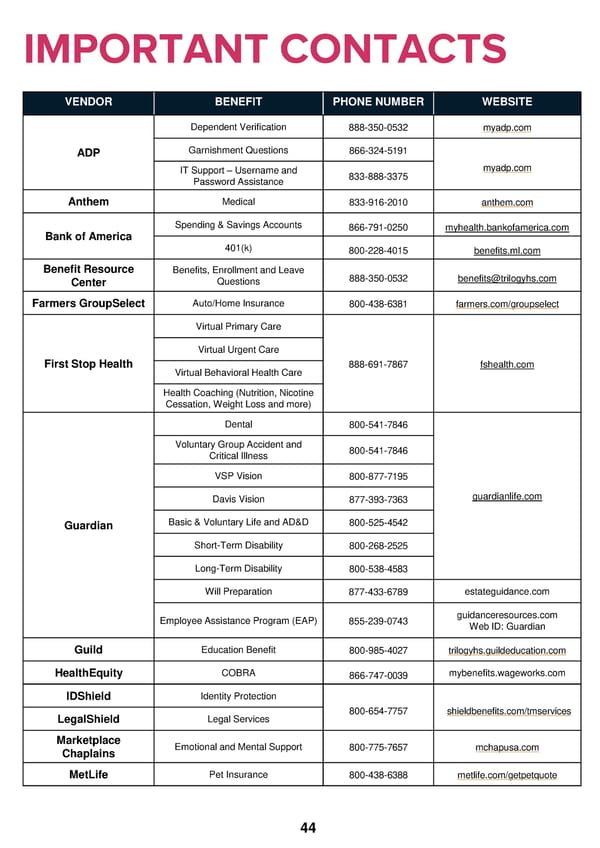

IMPORTANTCONTACTS VENDOR BENEFIT PHONE NUMBER WEBSITE Dependent Verification 888-350-0532 myadp.com ADP Garnishment Questions 866-324-5191 IT Support – Username and 833-888-3375 myadp.com Password Assistance Anthem Medical 833-916-2010 anthem.com Spending & Savings Accounts 866-791-0250 myhealth.bankofamerica.com Bank of America 401(k) 800-228-4015 benefits.ml.com Benefit Resource Benefits, Enrollment and Leave 888-350-0532 [email protected] Center Questions Farmers GroupSelect Auto/Home Insurance 800-438-6381 farmers.com/groupselect Virtual Primary Care Virtual Urgent Care First Stop Health Virtual Behavioral Health Care 888-691-7867 fshealth.com Health Coaching (Nutrition, Nicotine Cessation, Weight Loss and more) Dental 800-541-7846 Voluntary Group Accident and 800-541-7846 Critical Illness VSP Vision 800-877-7195 Davis Vision 877-393-7363 guardianlife.com Guardian Basic & Voluntary Life and AD&D 800-525-4542 Short-Term Disability 800-268-2525 Long-Term Disability 800-538-4583 Will Preparation 877-433-6789 estateguidance.com Employee Assistance Program (EAP) 855-239-0743 guidanceresources.com Web ID: Guardian Guild Education Benefit 800-985-4027 trilogyhs.guildeducation.com HealthEquity COBRA 866-747-0039 mybenefits.wageworks.com IDShield Identity Protection LegalShield Legal Services 800-654-7757 shieldbenefits.com/tmservices Marketplace Emotional and Mental Support 800-775-7657 mchapusa.com Chaplains MetLife Pet Insurance 800-438-6388 metlife.com/getpetquote 44

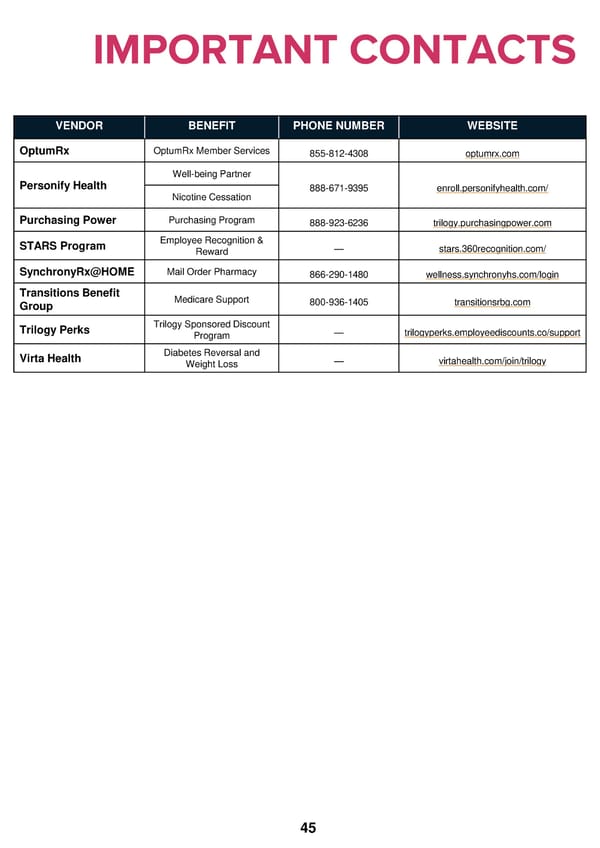

IMPORTANT CONTACTS VENDOR BENEFIT PHONE NUMBER WEBSITE OptumRx OptumRx Member Services 855-812-4308 optumrx.com Well-being Partner Personify Health 888-671-9395 enroll.personifyhealth.com/ Nicotine Cessation Purchasing Power Purchasing Program 888-923-6236 trilogy.purchasingpower.com STARS Program Employee Recognition & — stars.360recognition.com/ Reward SynchronyRx@HOME Mail Order Pharmacy 866-290-1480 wellness.synchronyhs.com/login Transitions Benefit Medicare Support 800-936-1405 transitionsrbg.com Group Trilogy Perks Trilogy Sponsored Discount — trilogyperks.employeediscounts.co/support Program Virta Health Diabetes Reversal and — virtahealth.com/join/trilogy Weight Loss 45

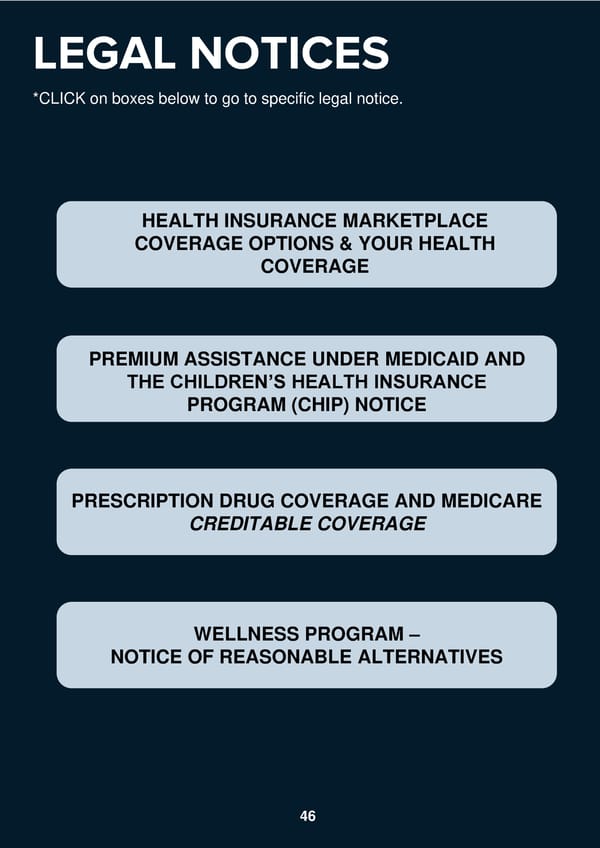

LEGAL NOTICES *CLICK on boxes below to go to specific legal notice. HEALTH INSURANCE MARKETPLACE COVERAGE OPTIONS & YOUR HEALTH COVERAGE PREMIUM ASSISTANCE UNDER MEDICAID AND THE CHILDREN’S HEALTH INSURANCE PROGRAM (CHIP) NOTICE PRESCRIPTION DRUG COVERAGE AND MEDICARE CREDITABLE COVERAGE WELLNESS PROGRAM – NOTICE OF REASONABLE ALTERNATIVES 46

WOMEN’S HEALTH AND CANCER RIGHTS ACT NOTICE “NO SURPRISE” BILLING INFORMATION NEWBORNS’ AND MOTHERS’ HEALTH PROTECTION ACT HIPAA NOTICE OF SPECIAL ENROLLMENT RIGHTS 47 47