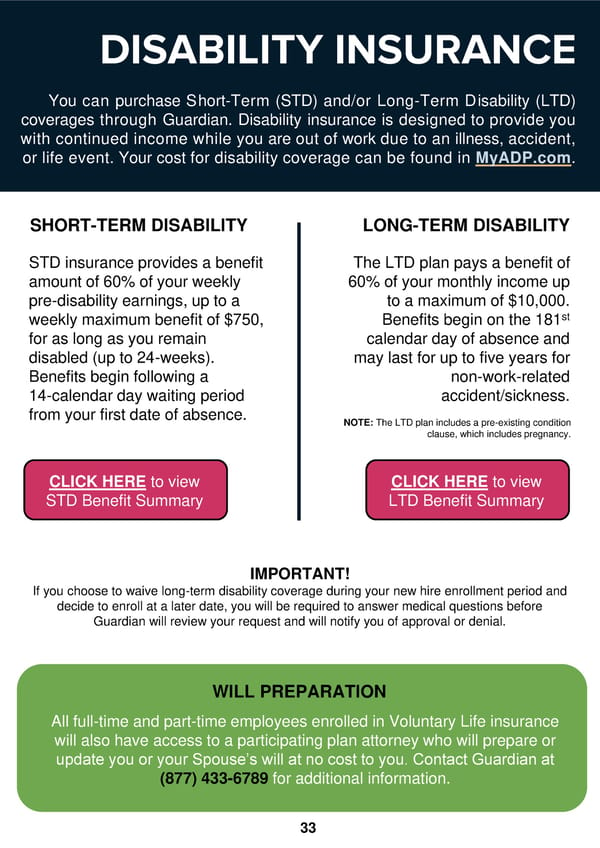

DISABILITY INSURANCE You can purchase Short-Term (STD) and/or Long-Term Disability (LTD) coverages through Guardian. Disability insurance is designed to provide you with continued income while you are out of work due to an illness, accident, or life event. Your cost for disability coverage can be found in MyADP.com. SHORT-TERM DISABILITY LONG-TERM DISABILITY STD insurance provides a benefit The LTD plan pays a benefit of amount of 60% of your weekly 60% of your monthly income up pre-disability earnings, up to a to a maximum of $10,000. weekly maximum benefit of $750, Benefits begin on the 181st for as long as you remain calendar day of absence and disabled (up to 24-weeks). may last for up to five years for Benefits begin following a non-work-related 14-calendar day waiting period accident/sickness. from your first date of absence. NOTE: The LTD plan includes a pre-existing condition clause, which includes pregnancy. CLICK HEREto view CLICK HEREto view STD Benefit Summary LTD Benefit Summary IMPORTANT! If you choose to waive long-term disability coverage during your new hire enrollment period and decide to enroll at a later date, you will be required to answer medical questions before Guardian will review your request and will notify you of approval or denial. WILL PREPARATION All full-time and part-time employees enrolled in Voluntary Life insurance will also have access to a participating plan attorney who will prepare or update you or your Spouse’s will at no cost to you. Contact Guardian at (877) 433-6789 for additional information. 33

Trilogy Health Services - 2025 Benefit Guide Page 32 Page 34

Trilogy Health Services - 2025 Benefit Guide Page 32 Page 34