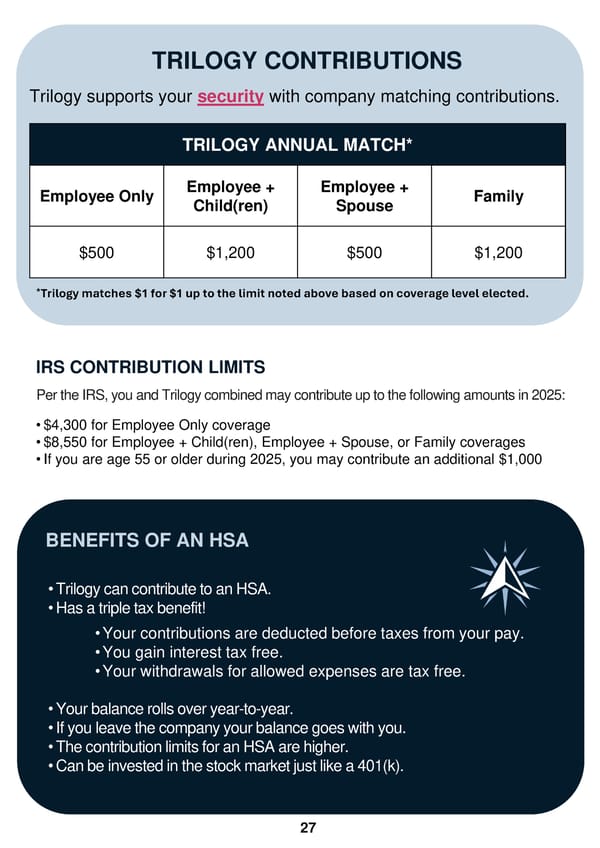

TRILOGY CONTRIBUTIONS Trilogy supports your security with company matching contributions. TRILOGY ANNUAL MATCH* Employee Only Employee + Employee + Family Child(ren) Spouse $500 $1,200 $500 $1,200 *Trilogy matches $1 for $1 up to the limit noted above based on coverage level elected. IRS CONTRIBUTION LIMITS Per the IRS, you and Trilogy combined may contribute up to the following amounts in 2025: • $4,300 for Employee Only coverage • $8,550 for Employee + Child(ren), Employee + Spouse, or Family coverages • If you are age 55 or older during 2025, you may contribute an additional $1,000 BENEFITS OF AN HSA •Trilogy can contribute to an HSA. •Has a triple tax benefit! •Your contributions are deducted before taxes from your pay. •You gain interest tax free. •Your withdrawals for allowed expenses are tax free. •Your balance rolls over year-to-year. •If you leave the company your balance goes with you. •The contribution limits for an HSA are higher. •Can be invested in the stock market just like a 401(k). 27

Trilogy Health Services - 2025 Benefit Guide Page 26 Page 28

Trilogy Health Services - 2025 Benefit Guide Page 26 Page 28