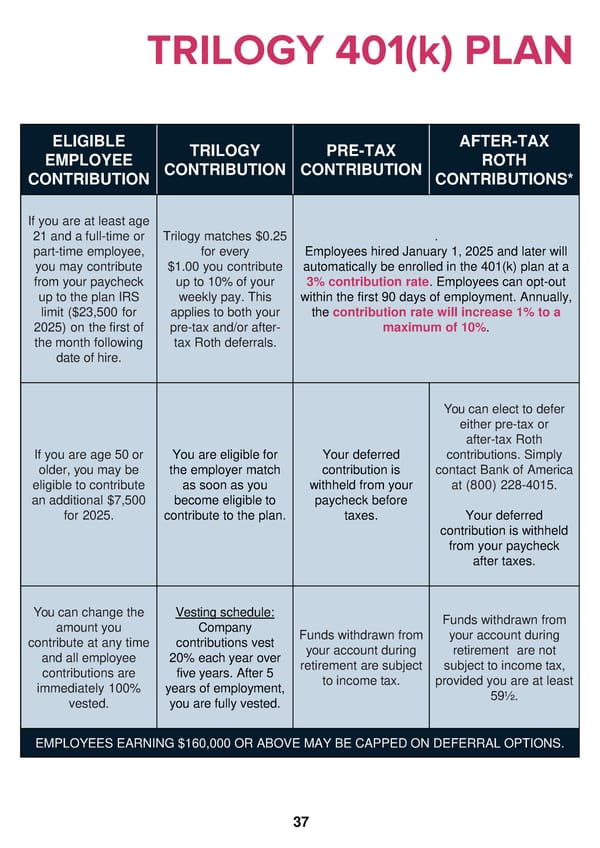

TRILOGY 401(k) PLAN ELIGIBLE TRILOGY PRE-TAX AFTER-TAX EMPLOYEE CONTRIBUTION CONTRIBUTION ROTH CONTRIBUTION CONTRIBUTIONS* If you are at least age 21andafull-time or Trilogy matches $0.25 . part-time employee, for every Employees hired January 1, 2025 and later will you may contribute $1.00 you contribute automatically be enrolled in the 401(k) plan at a from your paycheck up to 10% of your 3% contribution rate. Employees can opt-out upto the plan IRS weekly pay. This within the first 90 days of employment. Annually, limit ($23,500 for applies to both your the contribution rate will increase 1% to a 2025) on the first of pre-tax and/or after- maximum of 10%. the month following tax Roth deferrals. date of hire. Youcanelect to defer either pre-tax or after-tax Roth If you are age 50 or You are eligible for Your deferred contributions. Simply older, you may be the employer match contribution is contact Bank of America eligible to contribute as soon as you withheld from your at (800) 228-4015. an additional $7,500 become eligible to paycheck before for 2025. contribute to the plan. taxes. Your deferred contribution is withheld from your paycheck after taxes. Youcanchangethe Vesting schedule: Fundswithdrawn from amount you Company Fundswithdrawn from your account during contribute at any time contributions vest your account during retirement are not and all employee 20%each year over retirement are subject subject to income tax, contributions are five years. After 5 to income tax. provided you are at least immediately 100% years of employment, 59½. vested. you are fully vested. EMPLOYEES EARNING $160,000 OR ABOVE MAY BE CAPPED ON DEFERRAL OPTIONS. 37

Trilogy Health Services - 2025 Benefit Guide Page 36 Page 38

Trilogy Health Services - 2025 Benefit Guide Page 36 Page 38